Bankruptcy

Bankruptcy in North Alabama

Bankruptcy Law Firm | Crumbley-Blackwell-Price Attorneys

Accumulated debt from car loans, credit cards, and mortgages can become incredibly overwhelming and soon you may find yourself falling farther and farther behind on your payments. In such a scenario, what can you do to gain relief?

Initiating bankruptcy proceedings is one option that can help you get a fresh start on life. If you are looking for a reliable bankruptcy lawyer to assess your financial options, contact us today. We have decades of combined legal experience and can inform you of the best route to proceed, whether through bankruptcy or another alternative such as debt litigation. Let our Huntsville bankruptcy attorneys help you through this financially trying time with efficiency and compassion.

-

practice link

practice linkChapter 7

Chapter 7 bankruptcy is known as liquidation bankruptcy because debts are cancelled after all non-exempt property is liquidated.

-

practice link

practice linkChapter 13

Developing your Chapter 13 plan can be quite complicated. There are certain debts that must be paid back first, while others can be repaid partially.

-

practice link

practice linkDebt Litigation

Bankruptcy is not the only option to those who are seeking debt litigation in North Alabama.

-

practice link

practice linkBankruptcy Alternatives

Depending on your situation, bankruptcy may not be the best course of action for you. Before doing anything, contact a bankruptcy attorney.

-

practice link

practice linkBankruptcy Exemptions

When filing for bankruptcy, the government has created several exemptions which allow you to keep your personal belongings and property from seizure.

-

practice link

practice linkCreditor Harassment

If you are being harassed by a creditor, you can gain relief by contacting our experienced bankruptcy lawyers.

-

practice link

practice linkWage Garnishment

If you’re struggling with difficulties relating to wage garnishment or bankruptcy in North Alabama – schedule a consultation with a lawyer from our team.

-

practice link

practice linkRepossession

Whatever your situation may be, our bankruptcy lawyers can help devise a strategy to save your possessions.

-

practice link

practice linkMeans Test

The bankruptcy means test is a formula designed to determine who is eligible for filing Chapter 7 bankruptcy in Alabama.

Are there advantages to filing bankruptcy?

Bankruptcy is a legal tool through which a debtor can eliminate their debts or create repayment plans. Alabama bankruptcy laws were enacted to give debtors fresh financial starts. Filing for bankruptcy should be the last option and only resorted to when all other options have been discarded. It is a major decision and can leave a lasting effect on your finances. Before you file for bankruptcy, it is a good idea to seek experienced advice regarding your situation.

If you decide to file bankruptcy; you can benefit from several protections, such as the following:

There are several other benefits to filing bankruptcy, such as protection against discriminatory actions by private employers. You will also receive protection against government bodies, protection against incarceration, and more.

Alabama Bankruptcy Process

If you are considering filing for bankruptcy in Huntsville, Decatur, Madison, Athens or a surrounding area, be aware the bankruptcy process can be quite complicated and demanding. Here is a basic overview of what you can expect:

At this point, the next steps will again depend on the chapter that you filed. For Chapter 7, your debts will be discharged and you can move forward. For Chapter 13, you will need to complete the payment plan, which can last anywhere from 3-5 years. Once completed, your debts will be discharged. There are also other chapters of bankruptcy available as options for specific cases.

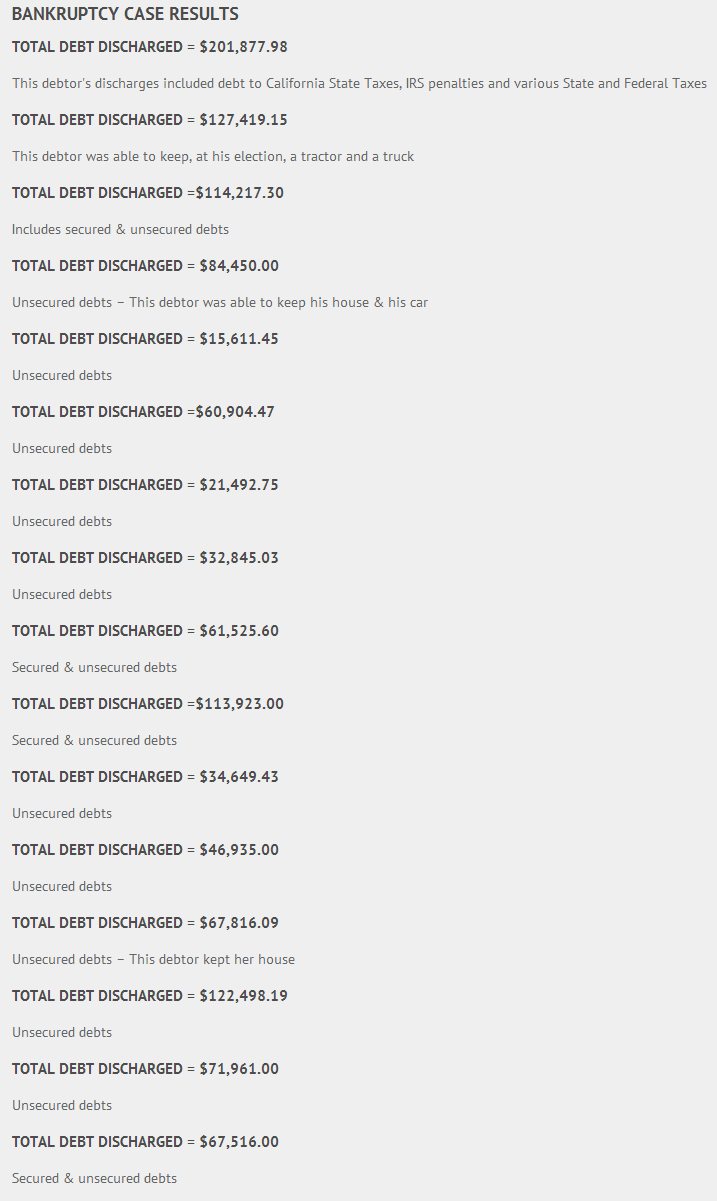

Recent Bankruptcy Case Results

Schedule a Consultation with a Bankruptcy Lawyer in Huntsville

Wondering how you should proceed? Our experienced bankruptcy attorneys at Crumbley-Blackwell-Price Attorneys can sit down with you and help you review your financial situation. We can inform you if you have any other options apart from filing for bankruptcy.

If there is no other option and you can gain protection from bankruptcy laws, we can quickly prepare a case for you. To learn more about bankruptcy filing, to file one in North Alabama, or for more information – contact a bankruptcy attorney from our team today to schedule a phone or office consultation.

contact us about your case

Still have questions? Schedule a consultation with a lawyer from our team today by calling or completing an online form

CONTACTS

OR

ADDRESS

- 2304 Memorial Pkwy SW, Huntsville, AL 35801

- 217 Randolph Ave SE, Huntsville, AL 35801

- 112 Market Street W., Athens, AL 35611

- 427 2nd Avenue SW, Suite 102, Cullman, AL 35055

- 5500 Southlake Park Suite 200, Birmingham, AL 35244

[gravityform id=”1″ title=”false” description=”false” ajax=”false”]

find us

by DD.NYC

by DD.NYC